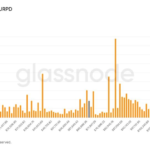

In a noteworthy development within the cryptocurrency sphere, a well-known Bitcoin figure has reentered the market after a two-week pause by transferring an impressive 1,176 BTC, which equates to approximately $136.4 million, onto the HyperLiquid platform. This transfer, reported on September 14, 2025, opens discussions around potential shifts in the market dynamics, with speculations that the entity might exchange these Bitcoin holdings for Ethereum (ETH), similar to previous patterns observed with large-scale transactions.

The implications of such a significant transfer have caught the eyes of traders focusing on Bitcoin price movements and Ethereum trading prospects. This activity could indicate changing sentiment in the crypto markets, particularly influencing BTC to ETH trading pairs and overall liquidity flows. The transaction is traceable through platforms like Hypurrscan and Arkham Intelligence, which highlight the transparency in crypto transactions. Onchain Lens noted that this Bitcoin entity, experienced in such moves, has retained the BTC within HyperLiquid, pointing towards a likely swap for Ethereum.

As Bitcoin experiences ongoing volatility, traders are closely examining critical support levels fluctuating between $50,000 and $55,000, while resistance has been observed around the $60,000 mark. Should this entity proceed with selling BTC for ETH, it may exert downward pressure on Bitcoin’s price, potentially propelling Ethereum’s upward momentum, particularly in light of burgeoning interest in decentralized finance and layer-2 solutions. Notably, trading volumes on major exchanges have surged, particularly in BTC-ETH pairs, indicating a spike in transaction velocities that coincide with such notable whale movements.

Historically, previous transfers of this nature by the same figure have been linked to short-term dips in Bitcoin prices, typically in the range of 2-5%, followed by significant rallies in Ethereum prices. These actions offer key insights for swing traders anticipating these correlations.

From a practical viewpoint, this development emphasizes the necessity for traders to monitor whale wallets and leverage on-chain data for predictive trading strategies. Investors may consider positioning themselves in Ethereum futures or spot markets, foreseeing a potential influx of capital stemming from BTC conversions. Historical data indicates that Ethereum trading volumes can surge by up to 15% within just 24 hours of similar swaps, frequently leading to short-term price appreciations of 3-7%.

Traders should keep an eye on important metrics, like the BTC dominance index, which may experience a decline if Ethereum continues to gain momentum. Furthermore, Ethereum’s gas fees might rise with the uptick in network activity generated by these transitions. For those exploring arbitrage opportunities, noteworthy price discrepancies may arise in cross-exchange spreads between Bitcoin and Ethereum, particularly on platforms recognized for their liquidity pools like HyperLiquid.

Moreover, the actions taken by this prominent Bitcoin figure hint at a broader sentiment in the market where institutional players are diversifying their investments from Bitcoin into altcoins, anticipating regulatory clarity and potential technological advancements. Employing analytical tools, such as moving averages—specifically the 50-day EMA for Bitcoin at around $58,000—can aid traders in identifying optimal entry points, whereas RSI levels above 70 might indicate overbought conditions for Ethereum after such a swap.

Looking beyond immediate price fluctuations, this transfer underscores the growing institutional interest in platforms like HyperLiquid, which could significantly enhance adoption and liquidity within the decentralized finance sector. Market participants should also take into account macroeconomic factors, such as the correlations with major stock market indices like the S&P 500; often, cryptocurrency trends mirror the performance of tech stocks.

If Bitcoin faces selling pressure as a result of this transfer, it could create a buying opportunity at lower support levels, which may lead to a rebound if overall market sentiment shifts positively. Conversely, Ethereum stands to benefit from this influx of capital. Key indicators, including active addresses and transaction counts, will play a critical role in forecasting future movements.

In conclusion, this significant activity by a Bitcoin heavyweight exemplifies how whale dynamics can generate trading volatility and opportunities, urging market participants to remain vigilant, utilizing real-time data and diversified strategies to navigate the ever-evolving landscape of cryptocurrency markets. As the crypto arena continues to grow, such events reaffirm the importance of on-chain analysis in shaping trading strategies, with both Bitcoin and Ethereum remaining crucial assets to monitor closely.