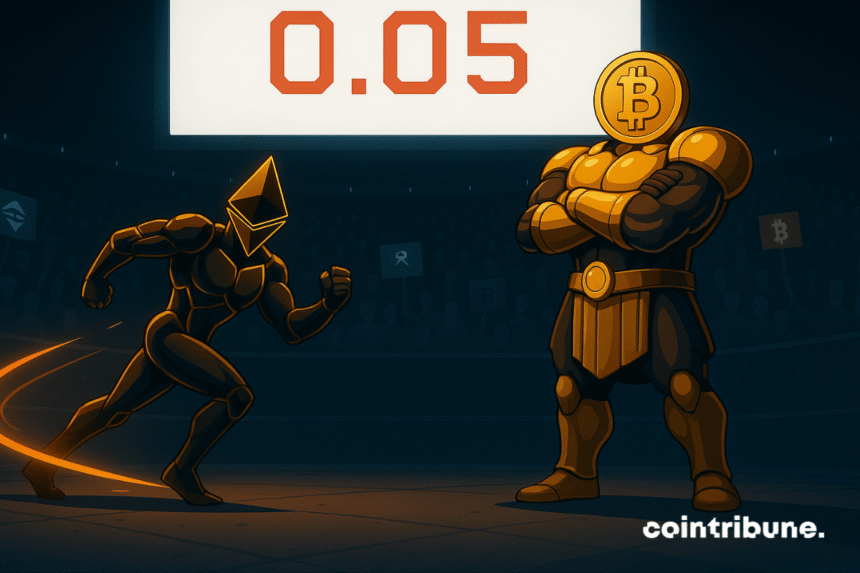

Ethereum (ETH) has seen a significant uptick in interest from institutional investors throughout July and August, contributing to the cryptocurrency achieving a new all-time high. However, despite this surge, Ethereum has struggled to match Bitcoin’s relative performance, as indicated by the ETH/BTC ratio, which evaluates the value of one ETH against BTC.

The ETH/BTC ratio has remained below 0.05 for an extended period, specifically for 14 consecutive months, marking a notable trend since it first dipped below this threshold at the end of July of the previous year. Historically, the longest duration of such low ratios spanned approximately 33 months from August 2018 to April 2021.

As of 2025, CoinGecko reported that the yearly average ETH/BTC ratio fell to 0.027, its lowest in five years. This number resembles the conditions seen during the mid-2019 to early 2020 bear market, driven primarily by Bitcoin’s substantial institutional backing and shifts in the trading dynamics of altcoins. In particular, a price drop in Ethereum was recorded on April 9, 2025, where it fell to $1,471, leading the ETH/BTC ratio to dip below 0.02—a level not seen since February 2020. Although this ratio bounced back to 0.04 following Ethereum’s prices hitting a record $4,946, the cryptocurrency has since seen a minor 6% decline, currently sitting at 0.039.

The impressive rebound of Ethereum’s price, rising more than 100% between July and August, can be attributed to financial institutions increasing their Ethereum holdings, growing investor engagement through ETFs, and the Ethereum Foundation’s initiatives to connect with key market players. CoinGecko has posited that if the ETH/BTC ratio recovers to 0.05 while Bitcoin stabilizes between $100,000 and $124,000, Ethereum could potentially reach new valuations ranging from $5,000 to $6,200.

Historically, Ethereum outperformed Bitcoin significantly from late 2015 to mid-2017, during which the ETH/BTC ratio peaked. However, since late 2020, Bitcoin has regained its dominance, leading to a downward trend in the ETH/BTC ratio and causing many trading days to be less profitable for Ethereum holders compared to those holding Bitcoin.

Despite these challenges, Ethereum has demonstrated resilience. Recent data from CryptoQuant reveals that institutional holders have doubled their Ethereum stakes since April 2025, now totaling 6.5 million ETH. Furthermore, large wallets containing between 10,000 and 100,000 ETH control over 20 million ETH collectively, which indicates strong engagement from significant market players. Additionally, staking has escalated to a record 36.15 million ETH, reinforcing long-term investment strategies, decreasing the circulating supply, and potentially tempering new inflows if price momentum experiences a slowdown.

The network’s activity is also surging, with total transactions and active addresses hitting record levels and daily smart contract interactions exceeding 12 million. Currently, ETH is trading at $4,639, reflecting a slight 1% decrease over the past 24 hours. While the second-largest cryptocurrency has faced challenges in keeping pace with Bitcoin in recent years, the prevailing market indicators suggest that Ethereum remains poised for further growth.