The current stock market landscape has drawn comparisons to the tumultuous year of 2011, a time when the S&P 500 was slowly recovering from the devastation of the 2008 financial crisis. Back then, the index had experienced a significant decline, plummeting nearly 50% at its lowest point. As the market began to rebound, many investors remained skeptical, anticipating further downturns, mirroring the cautious sentiment prevalent today.

The aftermath of the 2008 collapse left a lasting impression, especially for those entering the workforce around that time. The job market was bleak, characterized by layoffs and minimal hiring opportunities, which prompted some individuals, including recent graduates, to explore entrepreneurial ventures instead. With concerns about the economy lingering, one investor made the critical decision to sell off stocks purchased just before the collapse, convinced that the worst was yet to come. This sentiment persisted into 2011, leading to further market declines before a surprising turnaround began.

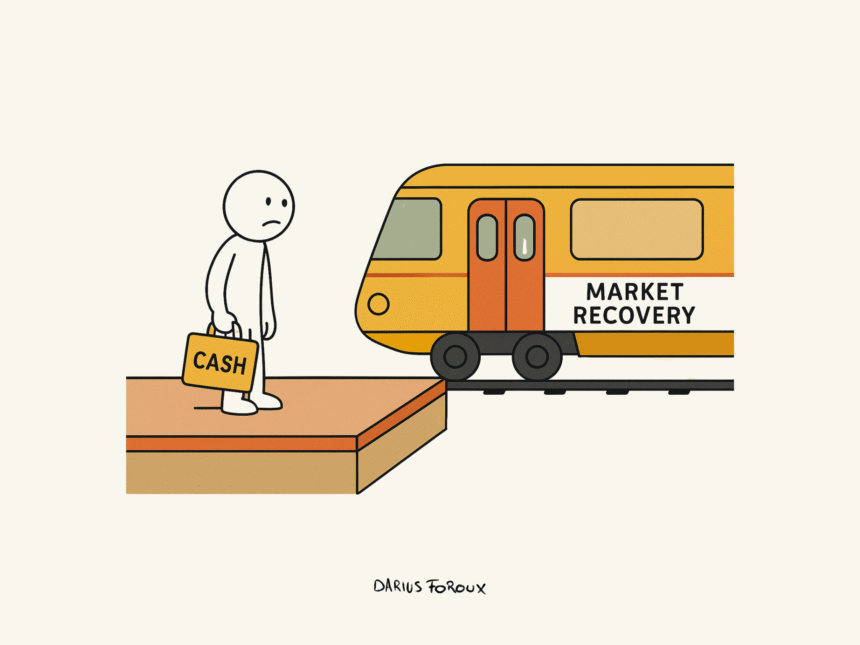

By late 2011, those who remained out of the market missed a significant recovery. Between September 2011 and September 2015, the S&P 500 surged nearly 70%, underscoring the often-unpredictable nature of financial trends. Recent events in the market have echoed this past experience; in April 2025, fears of recessions and trade tensions caused a steep decline in stock prices, with losses totalling around 20%. However, just as in previous years, a shift occurred—tariffs were eased, inflation rates showed signs of stability, and markets began to recover, ultimately climbing back to positive territory.

Current sentiment shows that, as of mid-September this year, the S&P 500 is up 12% year to date, highlighting a stark contrast to the fears expressed earlier in the year. Individuals who exited their investments during the downturn risked missing out on substantial gains. In the face of market volatility, some investors have maintained a more optimistic outlook, recognizing that opportunities often emerge during moments of panic.

A deeper understanding of investor psychology reveals how emotions can influence trading behavior. Hormonal responses to market conditions—such as rising testosterone in bull markets and heightened cortisol in bear markets—can significantly affect how investors make decisions. The continuing tension between fear and opportunity is palpable, particularly as enthusiasm builds around sectors like artificial intelligence and corporate earnings rise.

Personal financial circumstances can also impact attitudes toward risk-taking. For instance, commitments such as home-buying and family planning can lead individuals to adopt a more cautious investment stance, prioritizing capital protection over aggressive growth strategies. While previously more active in trading, many now choose to stay away from margin trading and consider potential losses and missed opportunities more seriously.

Key strategies for navigating the current market environment include:

- Avoid Timing the Market: Historically, missing recoveries can be more detrimental than experiencing temporary losses.

- Stay Invested: Maintaining investments over the long term often yields better results than trying to predict market fluctuations.

- Manage Risk: Investors should only invest amounts they are comfortable losing, diversifying their portfolios to minimize risk.

- Take Advantage of Dips: Market downturns can present excellent opportunities to invest when prices drop significantly before potential recoveries.

- Understand Emotional Drivers: Recognizing how emotions like fear and greed affect investment decisions can lead to more rational choices.

Prominent traders recognize the importance of momentum in the market. Past trends have shown that stocks often continue to rise, sometimes beyond rational expectations, until significant external factors disrupt that trajectory. Many investors err by treating every market dip as a signal of an impending downturn, overlooking the fact that often, it is not.

As the market continues to navigate uncertainties such as inflation, tariffs, and recession fears, seasoned investors remain disciplined and committed to their strategies. Embracing a contrarian mindset when justified while respecting ongoing market trends can protect against significant losses, which frequently arise not from making incorrect decisions but from being too late to act.