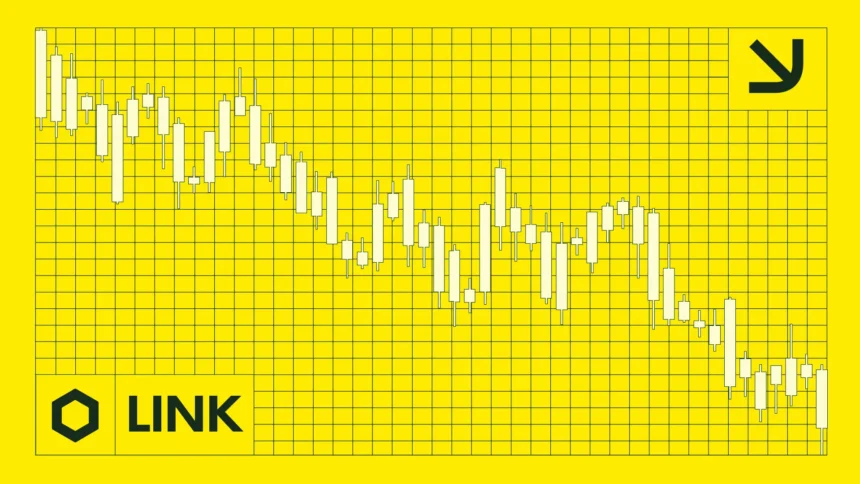

Chainlink (LINK) has experienced a significant downturn, with prices plunging 27% since reaching highs in August. Currently, LINK is valued at $20.24, a notable drop of 25% from its peak, raising questions about its future trajectory.

Following a breakout from a descending resistance trend line in June, Chainlink soared to an impressive high of $27.87 in August. However, it fell short of surpassing its previous cycle high by approximately 10%. The subsequent decline has resulted in four consecutive weeks of bearish candlesticks, leading to the current slump.

Despite this pronounced drop, several indicators suggest that the end of this correction could be near. Notably, momentum indicators, including the Relative Strength Index (RSI) — currently above 50 — and the positive trend in the Moving Average Convergence/Divergence (MACD), indicate that the long-term trend remains bullish. These factors hint at the possibility of LINK reaching new highs before the year concludes.

Analyzing the price action on a daily time frame, it appears that LINK is on the verge of hitting a bottom, if it hasn’t done so already. The wave count indicates that the asset has concluded wave four of an upward five-wave movement. The current price has bounced off a support trend line within a descending parallel channel, closely aligning with the 0.5 Fibonacci retracement support level. This adds strength to the argument that this could indeed be the bottom for Chainlink.

To solidify this bullish outlook, LINK needs to reclaim the $22.20 level and break free from the constraints of the parallel channel. Achieving this goal would pave the way for Chainlink to aim for a new cycle high, specifically targeting the 1.61 external Fibonacci retracement level at $32.61.

Overall, the indicators suggest that Chainlink’s recent downturn may be concluding, with the $20–$21 range potentially marking a significant bottom. If LINK manages to reclaim the $22.20 threshold, this could unleash a rally towards $32.61 and possibly set the stage for even higher prices as the year draws to a close.