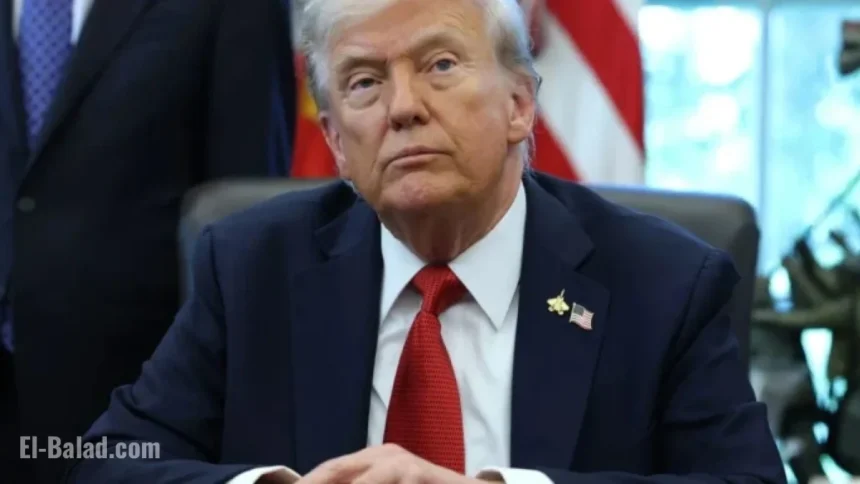

In a recent interview, former President Donald Trump suggested that American citizens could receive checks ranging from $1,000 to $2,000, funded by tariffs. However, experts have issued warnings that implementing such measures could trigger inflation, creating a potentially harmful feedback loop. Financial analyst Chris Motola from National Business Capital highlighted that the revenue generated from tariffs could lead to increased costs, further driving prices up for consumers.

Motola specifically pointed out that upcoming reports on inflation and employment—which are currently delayed due to a government shutdown—will be essential for assessing the economic repercussions of these proposed checks. He stated, “If the reports signal an economic shift, then these tariff-revenue checks might become more favorable and less inflationary,” indicating that the effectiveness of this proposal might hinge on the broader economic context.

Adding to the skepticism, Paul Johnson, an adjunct professor at Fordham’s Gabelli School of Business, cautioned against the inclination of consumers to treat these checks as “free money.” He argued that rather than saving the funds, consumers are likely to spend them, a behavior that historically contributes to inflation. Johnson characterized the notion of tariff-revenue checks as being more politically motivated than economically sound.

A White House official has responded to these speculations by asserting that there is no formal plan in place for issuing tariff checks, describing the analysis surrounding this proposal as based on unfounded assumptions.

The discussion has naturally drawn comparisons to previous stimulus initiatives. Trump has been a vocal critic of President Biden’s American Rescue Plan Act (ARPA), which provided $1,400 payments during the pandemic to individuals earning less than $75,000 and their dependents. While Trump’s proposed checks could appear similar in amounts, experts note that the current economic landscape—marked by rising inflation—is markedly different.

Motola further emphasized that while the nominal value of Trump’s suggested checks might align with those from the COVID relief programs, the real purchasing power has significantly declined when adjusted for inflation. This suggests that any new checks may offer diminishing benefits to consumers.

As the discourse on tariff-funded distributions continues, Johnson labeled the proposal a “giant charade,” arguing that it lacks a robust economic basis. The potential consequences of such policies remain unclear, prompting both consumers and economists to consider their implications on the broader economy.

As the global economic landscape evolves, attention will turn towards the upcoming Fortune Global Forum, scheduled for October 26–27, 2025, in Riyadh. The event will convene CEOs and leaders to discuss essential business trends and their implications, underscoring the ongoing interplay between economic policy and global business dynamics.