Bitcoin and other cryptocurrencies have faced a significant downturn since their recent highs in early October, raising concerns among traders about a potential $1 trillion market shrinkage. Currently, Bitcoin is valued at around $90,000, a notable drop from its record peak of $126,000 earlier this month. This decline comes as U.S. President Donald Trump hints at a potentially “immediate” shift in the market landscape.

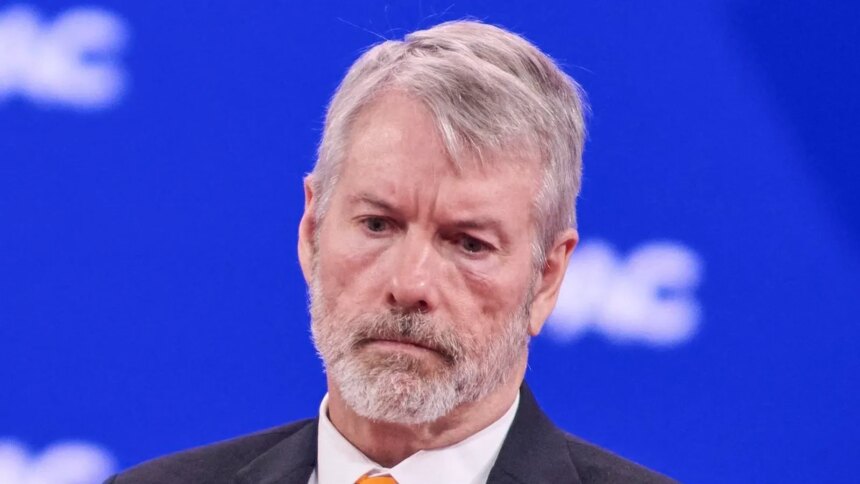

Amid these fluctuations, Michael Saylor, a prominent Bitcoin advocate and the CEO of the company Strategy, has raised alarms regarding potential upheaval in the crypto space. Saylor cautioned that if his company is removed from MSCI’s global equity indices, it could lead to “chaos, confusion,” and “profoundly harmful consequences” for the market. The SEC’s chair has also made a significant prediction concerning the crypto industry, adding to the ongoing uncertainty.

Saylor recently submitted a 12-page letter to MSCI urging the organization to reconsider its proposal that would exclude companies holding more than 50% of their total assets in cryptocurrency from its indices. Saylor and his chief executive, Phong Le, expressed their concerns in the letter, stating that MSCI should acknowledge the innovative nature of digital assets. They argued that it would be more prudent for MSCI to remain neutral and allow the market to define the future of crypto-adoptive companies.

Should MSCI implement this exclusion, a JPMorgan estimate suggests that Strategy could face an outflow of up to $8.8 billion from its stock, especially if other index providers adopt similar measures. Echoing Saylor’s sentiments, Adam Back, CEO of Blockstream, emphasized that the industry is still in its infancy regarding Bitcoin adoption and predicted that all companies would ultimately adopt Bitcoin as a treasury asset.

Adding to the market pressure, Standard Chartered has revised its Bitcoin price forecast for the end of 2025, halving its previous estimate from $200,000 to $100,000. Geoff Kendrick, the bank’s global head of digital assets research, noted that the buying spree by crypto treasury companies appears to have subsided, stating, “We think buying by Bitcoin digital asset treasury companies is likely over.”

Interestingly, Bitcoin treasury entities have purchased nearly 1 million Bitcoins this year, accumulating a total valued at almost $100 billion, which has now leveled with Bitcoin exchange-traded funds (ETFs) holding 1.5 million Bitcoins worth $1.4 billion. While the bullish buying trend among treasury companies seems to be fading, analysts expect ETF purchases to sustain until 2026.

Kendrick highlighted that future price increases for Bitcoin are likely to be driven solely by ETF investments. Given the current market environment, David Hernandez, a crypto investment expert at 21shares, noted that Bitcoin needs to overcome a concentrated short pressure around the $94,500 level to regain the $100,000 milestone. He suggested that if ETF inflows increase as anticipated, the combination of reduced capital costs and positive market sentiment could ignite renewed upward momentum in the Bitcoin market.