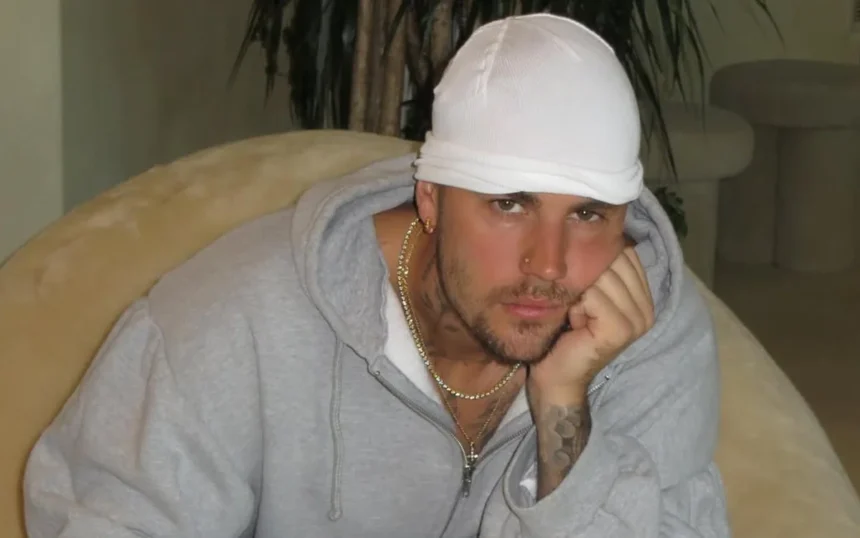

In what many are calling one of the starkest financial collapses in recent memory, the NFT market, once credited with promising massive returns on digital assets, has seen its valuations plummet dramatically. High-profile investments, highlighted by celebrity endorsements, have turned into financial misadventures, with Justin Bieber standing as a notable example.

Bieber made headlines in January 2022 when he purchased a Bored Ape Yacht Club (BAYC) NFT for an astonishing $1,301,550. This purchase was part of a wave that included various digital schemes like Dogecoin and Metaverse tokens, all aimed at replicating the monumental rise of Bitcoin. However, the allure of these digital collectibles has since faded, and Bieber’s investment now holds a fraction of its former value, with estimates placing it around $12,000—an eye-watering decline of over 99%.

The NFT market, particularly the BAYC series, attracted many ultra-wealthy individuals who hoped to capitalize on the trend. However, as prices soared during the initial surge, the reality has settled in, revealing a harsh truth: many of these digital tokens are now worth considerably less than what buyers paid. Current market conditions indicate that Bieber’s NFT could be likened in value to less than a typical oil change for his luxury vehicles, or roughly equivalent to a one-year-old Nissan Versa, which has gained recognition as one of America’s most budget-friendly cars.

This decline is not an isolated incident. The culpability does not rest solely with Bieber. Other celebrities have faced similar losses. Snoop Dogg, who purchased the “Right Click and Save As” NFT for $7 million, is now looking at a valuation of about $60,000. Meanwhile, Gary Vaynerchuk’s $4 million investment in a CryptoPunk is worth less than $50,000 today. The ramifications have left many other high-profile figures—such as Neymar Jr., Madonna, Eminem, Logan Paul, and Tom Brady—navigating substantial financial losses, each losing hundreds of thousands of dollars.

As the NFT marketplace struggles, legal challenges have surfaced as well. Yuga Labs, the creators behind Bored Ape NFTs, has faced lawsuits accusing them of using celebrity endorsements to artificially inflate and mislead potential investors about the true value of their digital collectibles. Claimants argue that these endorsements distorted the pricing and misrepresented the potential profitability of the NFTs.

While companies like Ferrari are attempting to breathe new life into NFTs, the overall sentiment among investors has shifted dramatically since the peak of hype. Bieber and others who embraced this digital revolution may now serve as cautionary tales in the landscape of digital currency and collectibles. The initial excitement appears to have given way to a more sobering narrative of investment lessons learned the hard way, highlighting the risks inherent in the volatile world of NFTs.