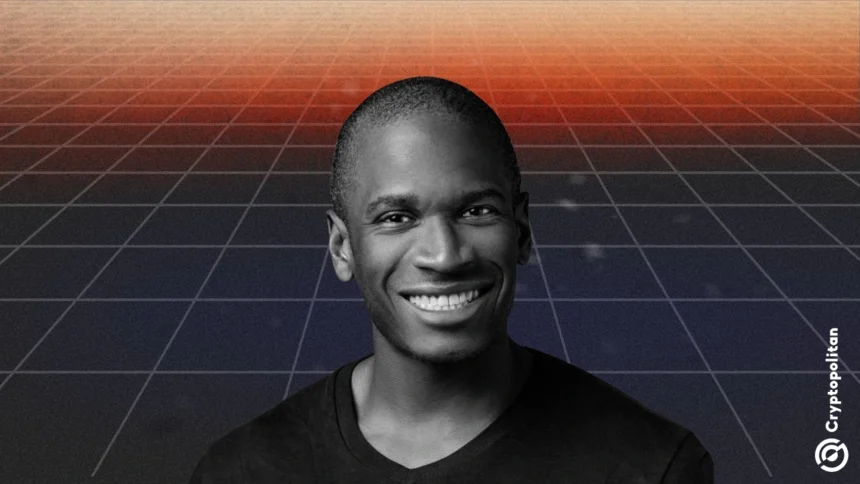

American entrepreneur Arthur Hayes has announced a significant shift in his investment strategy, opting to exit the memecoin space and redirect his focus toward high-yield decentralized finance (DeFi) protocols that promise tangible returns. The co-founder of BitMEX has spent recent years investing in various memecoins, including popular tokens like PEPE and MOTHER.

In a recent conversation with crypto investor Kyle Chasse, Hayes expressed concerns regarding the risks associated with digital assets, emphasizing his preference for investments that not only generate profits but also reward token holders for their contributions to the project’s success. He has a track record of advocating for DeFi protocols, touting the potential of platforms like EtherFi, Ethena, and Hyperliquid. Hayes believes that as the adoption of stablecoins accelerates, these projects could see significant growth, driven by an influx of yield-seeking capital.

Setting ambitious goals for himself, Hayes has outlined a target of achieving over 100x returns by 2028. He projects a 34x appreciation for EtherFi, 51x for Ethena, and as much as a 130x increase for Hyperliquid. Citing the importance of real revenue, product-market fit, and a value return model for token holders, he stated, “Investors have punished projects that either never made any money or made money and didn’t give it to tokenholders. We don’t want to touch it.”

Despite this pivot, Hayes remains bullish on Bitcoin, recognizing it as the best-performing asset during the era of extensive money printing. He anticipates that Bitcoin could potentially rise to $700,000 before the end of the decade. However, he asserts that the real asymmetric upside for Bitcoin presently lies within the emerging DeFi protocols, which he believes can capture significant capital expected to flow into stablecoins and on-chain markets.

Hayes urged Bitcoin holders to practice patience, advocating against focusing on traditional markets such as stocks and gold, which have recently reached record highs. He argued that inquiries about Bitcoin’s current price not being at $150,000 reflect a misguided perspective on cryptocurrency investments. He criticized traders who erroneously expect immediate returns, cautioning that such short-sightedness could lead to liquidation.

Addressing the frustrations of newer Bitcoin investors who are disheartened by its price, Hayes pointed out that long-term holders who purchased Bitcoin several years ago are in a vastly different position. He emphasized that investors should recalibrate their outlook, noting that Bitcoin has delivered an average annualized return of 82.4% over the last decade.

As of now, Bitcoin is experiencing a nearly 5% increase over the past week, trading at approximately $115,775, although it remains below its all-time high of $124,290. In contrast, gold has reached a new all-time high at $3,674 per ounce, and the S&P 500 has also recorded a record closing high of 6,587.

Hayes dismissed the importance of these milestones concerning Bitcoin, reiterating that the premise behind comparing it to traditional assets is fundamentally flawed. He maintains that Bitcoin stands as the most resilient asset in the face of currency debasement.