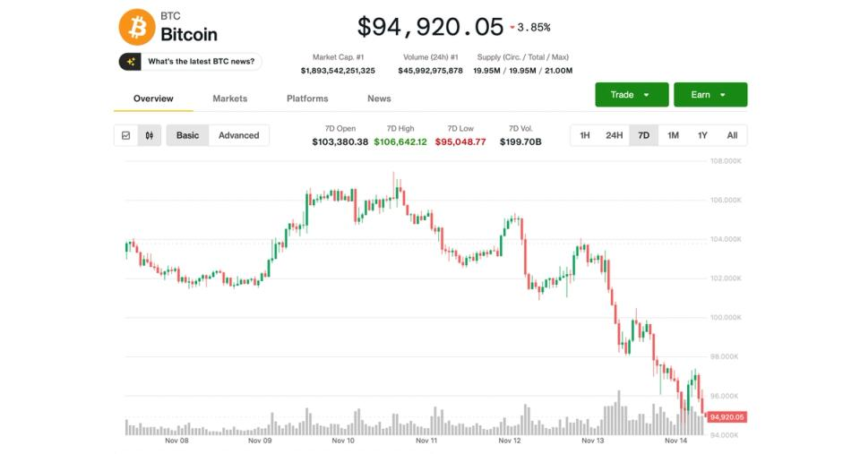

Bitcoin experienced a downturn on Friday, remaining at session lows below $95,000, following a tough week that saw prices fall to their lowest levels since May. The largest cryptocurrency is underperforming compared to major U.S. stock indices, which were showing slight gains as the trading day came to a close. Bitcoin is set to record a 9% loss for the week, marking its worst performance in eight months.

Ethereum, another prominent player in the cryptocurrency market, faced a more severe decline, trading below $3,200 and experiencing a drop of over 11% since the start of the week. Similarly, Solana reported a significant loss, shedding 15% during the same timeframe. XRP, on the other hand, managed to resist the downward trend, with a modest decline of just 1%, likely aided by the recent launch of its first spot ETF in the U.S. by Canary Capital.

In the realm of crypto-related equities, performances were mixed after a steep drop observed on Thursday. MicroStrategy, known as the largest public holder of Bitcoin, fell by another 4%, dipping below $200 for the first time since October 2024. Other entities such as Bullish, Ethereum treasury BitMine, as well as miners including CleanSpark, Marathon Digital Holdings, and Hive Digital also saw decreases in the range of 4%-7%. Conversely, the miner Hut 8 experienced a bounce of 6% following earnings results from its American Bitcoin joint venture with the Trump family, while digital brokerage Robinhood and BTC miner Riot Platforms both saw around a 3% rise.

Market analysts attribute the current downturn to an “information vacuum” that has significantly clouded investor confidence. This lack of clarity stems from the longest government shutdown in the U.S. since October 1, which interrupted the release of essential economic data including inflation and employment statistics. Analysts from Bitfinex pointed out that the suspension of these data releases has left investors in a holding pattern, uncertain about the future direction of monetary policy.

Adding to the cautious sentiment, a temporary spending bill passed by lawmakers only provides funding to sustain government operations until January 30, which does little to alleviate uncertainty. “The temporary funding bill doesn’t resolve the uncertainty; it just pushes the issue further down the road,” Bitfinex analysts noted.

Noelle Acheson, author of “Crypto Is Macro Now,” indicated that the recent decline could be viewed as a necessary correction following a long period of consolidation for Bitcoin, which had struggled to maintain a breakout above $120,000. She suggested that before any real recovery can occur, the market must first undergo this correction. Acheson emphasized that the ongoing macro liquidity situation remains a crucial factor for Bitcoin’s performance, and while a rate cut from the Federal Reserve may not come until early 2026, any adjustments in monetary policy could potentially restore optimism for risk assets.

Meanwhile, technical analysis from John Glover, Chief Investment Officer at crypto lending firm Ledn, suggests that Bitcoin’s price may still face further declines. He highlighted that breaking below the 23.6% Fibonacci retracement level, just under $100,000, could open the door for a decline to around $84,000. Glover expressed that this phase of pullback is part of a broader bear market for Bitcoin, predicting continued volatility in the coming months. Despite the challenges, he mentioned that prices may rebound above $100,000 before experiencing any significant movements below $90,000, with the overarching correction likely continuing until the summer of 2026.