Bitcoin experienced a significant surge, exceeding $120,000 on October 3, amid the backdrop of a partial US federal government shutdown that began on October 1. This shutdown was triggered after the Senate voted against a stopgap funding bill, leading to a lack of appropriations and impending furloughs for approximately 150,000 government employees. As uncertainty gripped traditional financial systems, investors turned to digital assets and gold, reinforcing Bitcoin’s status as a viable alternative store of value.

Just a day prior to the breakout, Charles Hoskinson, the founder of Cardano, offered a bold prediction in a Bloomberg interview, suggesting that Bitcoin could reach $250,000 by mid-2026, driven by ongoing geopolitical tensions. His comments resonate with many investors who view cryptocurrencies as safer havens during times of political turbulence.

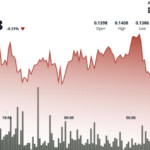

The repercussions of the government shutdown were swift, with financial markets reacting immediately. S&P 500 futures dropped substantially in early trading, while gold prices climbed by 1.1%, reaching $3,913.70 per ounce. Bitcoin’s value rose by over 2% within the same period, climbing to $116,400 before the momentum carried it past the $120,000 mark. Deutsche Bank strategist Jim Reid noted in a client memo that the absence of regular economic data releases—such as employment and inflation metrics—left investors and policymakers navigating in “complete blindness.”

Analysts are increasingly seeing the shutdown as a catalyst for market volatility, with some suggesting that delaying economic data could prompt the Federal Reserve to consider a 25 basis point interest rate cut in October. Matt Mena, a strategist at 21Shares, emphasized that lower real yields and a depreciating dollar have historically created favorable conditions for Bitcoin.

Hoskinson’s outlook aligns with the prevailing sentiment that Bitcoin could emerge stronger amid geopolitical fragmentation. He reiterated that circumstances between the US, Russia, and China are complicating conventional banking relationships and that Bitcoin could serve as a global settlement layer, free from political constraints. At the TOKEN2049 event, he discussed the potential for cryptocurrencies to redefine global finance, especially as major tech companies like Apple, Microsoft, Visa, and Mastercard show heightened interest in advancing crypto integrations.

The ongoing crisis underscores the potential challenges for the US economy. Economists warn that the longer the shutdown persists, the more pronounced the negative impacts on GDP will be, with estimates suggesting a possible decline of 0.1 to 0.2 percentage points for every week that the government remains closed. A complete quarter of disruption could potentially reduce growth by as much as 2.4 percentage points.

These predicted contractions could inherently increase the likelihood of further monetary easing from the Federal Reserve, fostering conditions that might accelerate capital flows into digital assets. As traditional metrics become unavailable due to the shutdown, heightened uncertainty prevails in the markets, with many viewing Bitcoin as one of the few assets that can thrive amidst systemic failures.

Hoskinson’s predictions of crypto potentially dominating global finance within three to five years appear more relevant than ever. He remarked, “Crypto is 3–5 years away from taking over the world,” aligning with the growing perception that as confidence in traditional systems wanes, decentralized assets like Bitcoin are poised to gain increasing traction among investors. This event highlights both Bitcoin’s evolving role as a hedge against traditional financial instability and its potential as a barometer of broader economic fragility.