The dollar held steady on Monday, with traders anticipating a series of speeches from Federal Reserve officials planned for the week. These addresses are expected to shed light on the U.S. interest rate outlook, particularly after the central bank resumed its easing cycle last week.

Early trading in Asia exhibited muted currency fluctuations, contrasting with the heightened volatility seen the previous week following critical rate decisions from the Fed, the Bank of England (BoE), and the Bank of Japan (BOJ). The yen (USDJPY) dipped by 0.16%, settling at 148.22 per dollar, as it retraced gains from the previous Friday. This decline follows a hawkish shift in the BOJ’s language, hinting at the possibility of a near-term rate hike.

The British pound (GBPUSD) experienced a setback, dropping to a two-week low of $1.3458. This decline was exacerbated by unfavorable domestic conditions, including a significant increase in UK public borrowing coupled with a BoE rate decision that highlighted the difficulty policymakers face in balancing economic growth and inflation. Jane Foley, head of FX strategy at Rabobank, noted a shift in expectations regarding the BoE’s next interest rate move, pushing forecasts for a potential cut into 2026. She added that while this has largely been factored into market valuations, GBP is likely to remain under pressure into the autumn and possibly beyond.

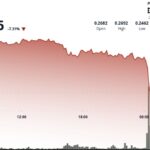

In the broader context, the dollar managed to continue its recovery from a sharp decline following the Fed’s announced rate cut, inching up slightly against a basket of currencies (DXY), reaching 97.75. The euro (EURUSD) lowered by 0.07% to $1.1738, whereas the Australian dollar (AUDUSD) eased 0.02% to $0.6589.

With approximately ten Fed officials set to deliver speeches this week, investors are keenly attentive to their insights regarding the economy and the independence of the Fed. Joseph Capurso, head of FX, international, and geoeconomics at Commonwealth Bank of Australia, highlighted the potential impact of these speeches on currency markets. He particularly noted that the address from Stephen Miran would hold significant interest, as it may provide insight into the independence of the Fed and the influence of the presidency on policy decisions.

New Fed Governor Miran recently defended his position as an independent policymaker following a dissenting opinion favoring a more substantial 50-basis-point rate cut during the September policy meeting. He is expected to elaborate on his perspectives in a speech scheduled for later in the day.

In Asia, China’s decision on Monday to maintain benchmark lending rates for the fourth straight month in September aligned with market expectations. Following this announcement, the offshore yuan (USDCNH) remained relatively stable, rising by 0.06% to 7.1151 per dollar.