Ethereum’s recent price recovery has faced challenges, settling at $4,294 as long-term holders opt to cash in on their investments, influenced by a notable increase in selling activity. The LTH (Long-Term Holder) Net Unrealized Profit and Loss metric signals that these seasoned investors are realizing profits, particularly noticeable as the metric reached a level of 0.65, often indicating that investor enthusiasm may be waning.

The recent uptick in the Coin Days Destroyed metric, which measures activity from long-term holders cashing out their positions, has also hit a two-month high. This surge suggests a growing concern among holders about the immediate prospects of price recovery, as established investors seem less confident in maintaining their stakes at current levels.

Adding to the bearish sentiment, U.S.-based spot Ether ETFs experienced significant outflows, totaling $787.6 million during the shortened trading week around Labor Day. A particularly notable drop occurred on Friday, with $446.8 million exiting these investment vehicles. This sharp decline contrasts sharply with August’s performance, where Ether ETFs enjoyed $3.87 billion in net inflows, while Bitcoin ETFs saw a more modest increase of $250.3 million during the same period.

Market analyst Ted suggests that inflows may resume if Ethereum can sustain its upward movement, although the immediate outlook remains clouded by selling pressures from various fronts. The mixed signals from institutional investors reflect an uncertainty regarding Ethereum’s short-term trajectory, a stark contrast to the strong ETF demand seen in the previous month.

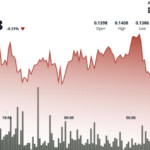

Examining Ethereum’s price levels, the cryptocurrency continues to grapple with resistance around the $4,500 mark, which it has repeatedly failed to breach in recent sessions. Alternatively, support is positioned at $4,222, a level that has remained intact despite ongoing fluctuations. This scenario hints at a range-bound trading pattern in the near term, with market participants keeping a close eye on demand indicators.

For Ethereum to break through the $4,500 resistance, there would need to be a significant uptick in buying activity, also suggesting that a breakout could propel the price towards the next resistance level at $4,749. However, the prevailing selling pressure could stall this potential recovery, propelling the need for either renewed institutional interest or a reduction in liquidation activity among long-term holders.

In a somewhat positive note amid the selling pressures, corporate treasuries now oversee 2.97% of the total Ethereum supply, valued at approximately $15.49 billion. BitMine stands as the largest corporate holder, with about $8.04 billion in Ethereum assets. Despite the current market fluctuations, BitMine’s chairman, Tom Lee, remains optimistic, maintaining a long-term price target of $60,000 for Ethereum.

Moreover, wallets holding between 1,000 and 100,000 ETH have increased their holdings by 14% since the lows observed in April, indicating accumulation despite a lackluster retail sentiment. This accumulation from both corporate and whale investors provides crucial underlying support, though it has yet to sufficiently counteract the selling activities from long-term holders and ETF redemptions, setting the stage for a pivotal moment in Ethereum’s price journey.