The Marshall Islands has embarked on a groundbreaking initiative by introducing a national universal basic income (UBI) program, offering payments through cryptocurrency alongside traditional methods. Experts have hailed this as a pioneering scheme, the first of its kind globally. Under this program, every citizen residing in the Marshall Islands is set to receive quarterly payments amounting to approximately $200, a part of a governmental effort to alleviate the rising cost of living faced by its residents. The initial payments were dispatched in late November, with recipients given the option to receive funds directly into a bank account, by cheque, or through cryptocurrency using a government-backed digital wallet.

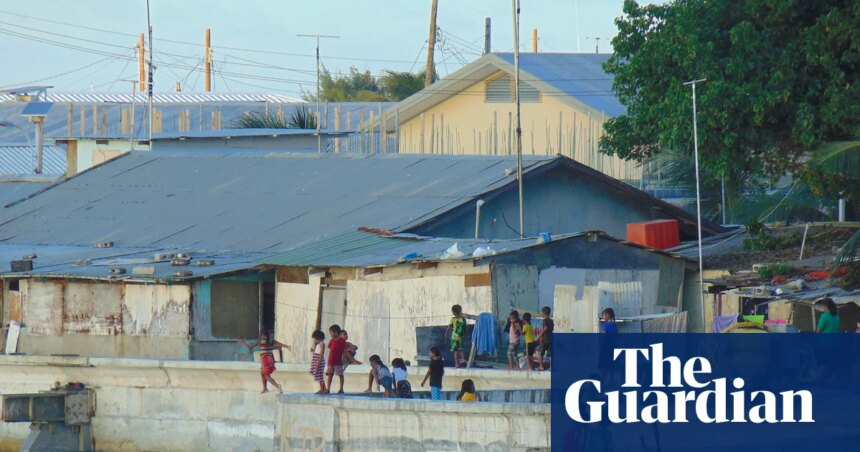

David Paul, the nation’s finance minister, emphasized the government’s commitment to ensuring that no citizen is overlooked. “$200 per person per quarter, which equates to about $800 a year, does not compel you to quit your job … but it’s actually like a morale booster for people,” he stated. As a remote archipelago located between Hawaii and Australia, the Marshall Islands has a population of roughly 42,000 residents. The UBI payments are conceived as a “social safety net” in response to increasing living costs and the migration of citizens seeking better opportunities elsewhere.

The UBI is funded by a trust established under a bilateral agreement with the United States, which compensates the Marshall Islands for decades of American nuclear testing. This trust reportedly holds over $1.3 billion in assets, with the U.S. further committing $500 million through 2027.

Dr. Huy Pham, an associate professor and crypto-fintech lead at RMIT University, has identified the scheme as a historical first in the context of a national rollout of UBI. He pointed out that the integration of blockchain technology, particularly with a nationwide implementation, is unique. The cryptocurrency component involves transferring a digital token, a stablecoin tethered to the U.S. dollar, designed to overcome challenges related to delivering financial support across the numerous remote islands that comprise the nation.

“We saw the opportunity in what the blockchain has to offer,” Paul remarked, highlighting the potential advantages of using blockchain technology, which, while best recognized as the foundation for cryptocurrencies like Bitcoin, can also facilitate the transfer of traditional assets, such as government bonds.

However, experts have cautioned that merely providing digital payment options does not guarantee financial inclusion, especially in a nation like the Marshall Islands, where internet connectivity is often inconsistent. Dr. Pham noted that improving internet infrastructure and expanding smartphone access are essential prerequisites for fostering a robust blockchain-based economy.

The uptake of the cryptocurrency payment option has been limited so far, with most individuals opting for traditional methods. Reports indicate that around 60% of the first round of payments were directly deposited into bank accounts, while the remainder were issued as paper cheques. Only approximately 12 recipients have opted for the cryptocurrency payments through the digital wallet thus far.

Anelie Sarana, the finance manager involved in the scheme’s implementation, mentioned that her team has made efforts to reach even the most remote islands to register participants. Many recipients reportedly utilized the funds for basic necessities, while others allocated the money for celebrations, coinciding with the annual Gospel Day holiday during the first distribution.

This isn’t the first instance of the Marshall Islands exploring cryptocurrency initiatives. In 2018, the government attempted to introduce a national cryptocurrency called the Sovereign (SOV), but the project faced setbacks after receiving warnings from the International Monetary Fund (IMF).

The IMF has expressed concerns about the potential risks associated with this innovative delivery mechanism for UBI, highlighting issues of financial integrity and governance that must be addressed. Dr. Monique Taylor, a lecturer at the University of Helsinki, remarked on the challenges of predicting the success of this experimental UBI model, especially as universal income programs at the national level remain uncommon. However, she pointed out potential advantages, asserting that for small island nations, a digital wallet could facilitate easier monetary access in regions where traditional banking infrastructure is limited.