Bitcoin’s recent plunge to near $77,000 has sent shockwaves throughout the cryptocurrency community, with social media buzzing with alarm. This dramatic fall dropped the largest digital asset below the significant $80,000 mark, marking levels not seen since the tumultuous events of April 2025, when market volatility was driven by geopolitical tensions.

As of Saturday afternoon, Bitcoin stood at roughly $77,000, a stark contrast from its October peak above $126,000. This staggering decline represented an erasure of approximately $800 billion in market value, sparking the liquidation of about $2.5 billion in leveraged long positions in just 24 hours. The fallout has been severe enough to push Bitcoin out of the global top 10 assets, where it had maintained a secure position for an extended period, now trailing corporations like Tesla and Saudi Aramco.

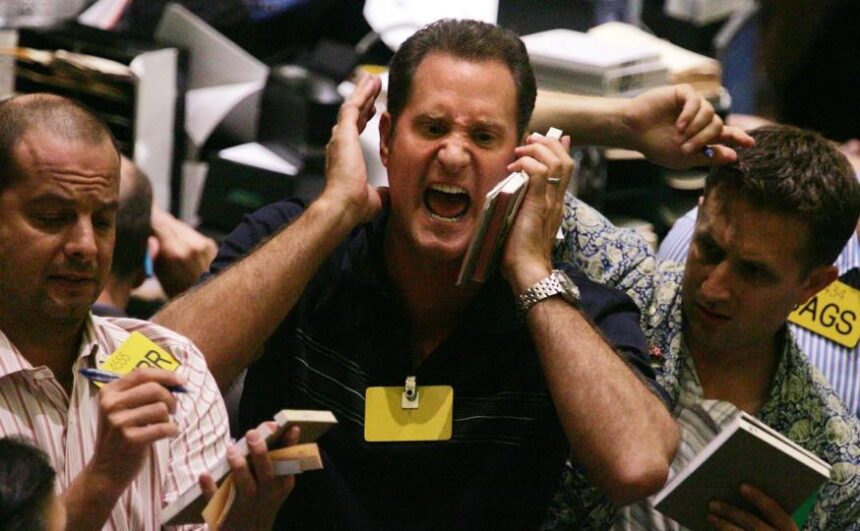

On social media, sentiments are harsh, with many users expressing their disbelief and panic. The selloff, however, is not confined to Bitcoin alone; the broader market has seen a wave of downturns across various asset classes, including tech stocks and precious metals, marking a historic week of losses.

Several factors are converging to create this atmosphere of “Extreme Fear”:

-

Geopolitical Tensions: Recent reports indicate a potential escalation in military tensions between the U.S. and Iran, which has led to a drastic drop in risk appetite among traders. Traditionally viewed as a safe haven, Bitcoin is now treated as a liquidity source during times of crisis, with investors opting to convert it to cash to weather losses, despite the expectation for a flight to safety.

-

Hard Assets Under Pressure: Gold and silver, typically considered safe investments, have also suffered. Gold fell by 9% to below $5,000, while silver crashed 26% in a single trading session. Analysts attribute this decline to a strong U.S. dollar, which has surged in value following the nomination of Kevin Warsh to lead the Federal Reserve.

-

Market Liquidations: The market, already weakened, experienced a mechanical breakdown as Bitcoin’s price dropped. Data indicates that over $850 million in bullish positions were liquidated in just hours, exacerbating the downward pressure as forced selling triggered further sell-offs.

-

Concerns for Major Investors: Michael Saylor’s company, Strategy, saw a significant drop as Bitcoin’s price fell below his average entry point, raising concerns about potential forced selling. However, it was clarified that Saylor’s Bitcoin holdings are not pledged as collateral, meaning he might not be in immediate danger. Despite this, the selling pressure contributes to a more defensive market sentiment.

As the crypto landscape shifts, Wall Street is also feeling the ripples, with U.S. stock futures indicating a downward trend across major indexes, suggesting a potentially tumultuous trading day ahead.

The divide among investors is stark. Small investors, often referred to as “small fish,” have been offloading their Bitcoin holdings, driven by fear and the steep drop from previous highs. Conversely, “mega-whales” are consolidating their positions, purchasing coins from panicking retail traders but failing to exert upward pressure on prices.

Amid this turmoil, some analysts point to a larger narrative, suggesting that current market dynamics echo past speculative bubbles seen in 2021. While institutional players like BlackRock and JPMorgan are increasingly investing in cryptocurrency, the specter of previous downturns still looms large, leaving many to reconsider the trajectory of Bitcoin and the broader market.

Comparing this situation to past experiences raises the question of how deep this downturn could go. An 80% decline from the peak could potentially see Bitcoin tumble to around $25,000, a sobering prospect that weighs heavily on market participants. The last bear market ended after the collapse of multiple failing projects, and whether current figures will face similar fates remains to be seen. As the adage goes, “It’s only when the tide goes out that you discover who’s been swimming naked” – a sentiment that appears increasingly relevant as investors brace for an uncertain future.